What are the benefits of death cover?

- Financial protection for your family in the event of your death

- Choice of three options to build up a death benefit for your loved ones

How does it work?

Thanks to death cover, your loved ones will receive an additional amount of capital (in branch 21) to secure their financial future.

You can choose from several options:

- Defined amount: you define in advance the minimum amount that your loved ones will receive. Have you not yet saved this amount at the time of your death? Securex covers the difference. Have you already saved more than expected? Then Securex pays the total amount of your savings to your surviving relatives.

- Additional capital: you determine in advance the additional capital that your loved ones will receive. After your death, your loved ones receive this additional capital on top of the amount you have already saved.

- Capital after an accident: Your loved ones will receive a predetermined amount if you die as a result of an accident.

These options are part of our customised Life@Ease offer.

Examples

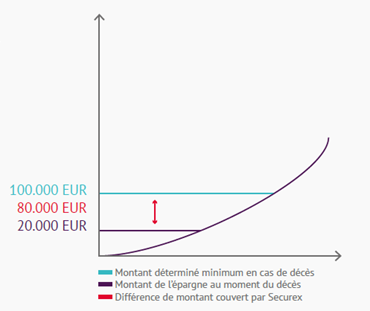

Defined amount

At the start of your contract, you stipulate that your surviving relatives must receive at least 100,000 euros in the event of your death. That is the set minimum amount.

At the time of your death, you already saved 20,000 euro as part of your contract. Securex then covers the difference of 80,000 euros. This way, you are certain that your surviving relatives receive the predetermined amount of 100,000 euros.

And what if you had already saved 130,000 euros at the time of your death? Securex pays that 130,000 euros to your surviving relatives.

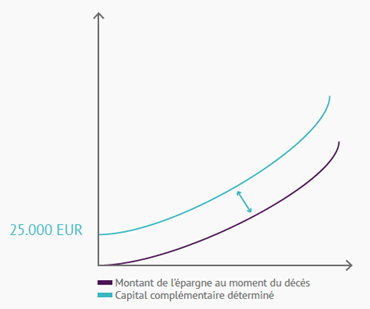

Additional capital

When you subscribe to your contract, you stipulate that in the event of your death your next of kin must receive 25,000 euros in addition to the amount you have already saved. This is the established additional capital.

At the time of your death, you had already saved 20,000 euros. So your surviving relatives receive an amount of 45,000 euros. Securex covers the difference of 25,000 euros.

Capital after an accident

The capital after an accident is also a predetermined amount that is paid out, but only if the insured dies within 180 days after and as a direct consequence of an accident.