Considerations for international employment

When your employees cross the border to work, this is a form of international employee mobility. In that case, the biggest challenge lies in complying with the rules of international law and those of the countries concerned.

Three points are key here, and they are analysed by Securex to ensure that your profession is lawful and problem-free, i.e.:

- What social security system applies?

- What employment law takes precedence?

- What are the tax implications?

You will also need to comply with the local employment rules and administrative formalities, which means documents such as Limosa, the A1 form or work permit. The experts at Securex analyse all these aspects and ensure the smooth and correct progress of your employee's secondment.

The benefits of international employment

The benefits of cross-border operation are huge. Not just for your company, but for your employees too. A brief overview.

Advantage | Description |

Win the War for Talent | The search for talent to suit your company gets harder as the years go by. Working abroad is a unique opportunity which candidates will not find at many other companies, making your company stand out from the competition. This can also be an opportunity to optimise your employee's salary package |

Lower personnel costs | When you employ personnel in different countries, you can organise your cross-border cost structures strategically. Thereby creating extra financial breathing room for you and your employees |

More flexible and challenging work | Working abroad is high on the list of many jobseekers as an opportunity for adventure, unique experience and a high degree of autonomy. They get more enjoyment from their work and build autonomous motivation |

Work Permits

If you are aiming to employ a Belgian employee abroad, you will need to comply with the rules for that country. The rules can be found on the government websites of that specific country or by consulting one of our local partners.

There are different types of employment permits in Belgium, depending on the candidate profile. For that reason, the answers to certain questions will determine what you need.

Determining factors

International employment is a complex affair. The documents and permits required depend on several factors.

- Duration: up to 90 days (work permit), indefinite duration for more than 90 days

- Origin: does your foreign employee come from a member state of the European Economic Area (EEA) or not? If so, you do not need a permit for employment. If not, you will need a single permit. More information on this is available here.

- Region: in what region do you aim to employ your worker?

- Status: is your worker in paid employment or self-employed?

- Profile: does your employee have a higher education diploma, or indispensable skills, or do they fill a shortage on the Belgian labour market (consider bottleneck professions, for example)?

Combined permit or single permit

If you need permission to work, it is highly likely that you will need to apply for a single permit. You will require this if you need to employ a non-European worker in Belgium, irrespective of whether you are a Belgian or foreign employer

Please note: depending on the region, the application process can take up to 4 months to complete. Be sure to start the process well in advance.

Although subcontracting in the construction industry very often involves foreign partners, the profession is more regulated than many other professions. For that reason, each applicant undergoes more thorough scrutiny.

What is a salary-split?

The term salary-split refers to the practice of splitting taxes on foreign employment in two or more countries. You pay taxes locally on the portion of work that your employee carries out in that specific country. This is also known as the 'work-country principle'.

A simple example: if your employee works 2 days a week in Belgium and 3 days a week in the Netherlands, you will only pay tax in Belgium for those 2 days. For the other 3 days, you will pay tax in the Netherlands.

Employees do not automatically pay taxes in both countries. Specific rules are used to regulate this.

Therefore, salary splitting is a way for international companies to optimise their remuneration policies. In short, a salary-split can be applied in all directions: foreign companies with Belgian employees, Belgian companies with foreign employees, multiple employers, and so on.

The special tax regime for inpats or incoming taxpayers (BBIB)

In 2021, the Belgian government passed a law abolishing the special tax regime for some foreign executives and introduced an entirely new special tax regime for incoming taxpayers.

The new legislation aims to provide a clear, simple and transparent legal framework for companies and prevent the abuses under the old special tax regime.

The focus has now returned to attracting highly qualified foreign personnel with specific skills, for which there is a shortage on the Belgian labour market, and enhancing our country's attractiveness for foreign investors.

Would you like any information or guidance on this matter? Securex is there for you.

Limosa & social security

Every employee who is normally employed abroad or was recruited there but will work temporarily or partially in Belgium, must be reported by their employer to the RSZ (National Social Security Office). This is the Limosa declaration. This obligation also applies to self-employed workers from abroad.

For the following professionals, you, as a foreign employer, must submit a Limosa declaration:

- Employees active in Belgium who are not covered by Belgian social security

- Employees active in both Belgium and abroad

- Foreign self-employed individuals seeking to work in Belgium

For employees in any sector, from the EEA, working in an international context, you request an A1 certificate. For employees from outside the EEA you request “a Certificate of Coverage”.

Limosa only applies in Belgium. Other countries have their own alternatives. This is why it makes sense to work with a partner like Securex, which relies on an extensive European network.

What Securex International can do for you

International employment is a particularly complex matter. If anything goes wrong, you risk high costs, fines and even penalties. Choose peace of mind and certainty by outsourcing the formalities to an experienced partner.

When comparing partners, you will see that Securex is uniquely suited as a partner for international employment.

- Experience the convenience of a single point of contact to guide you through the entire process

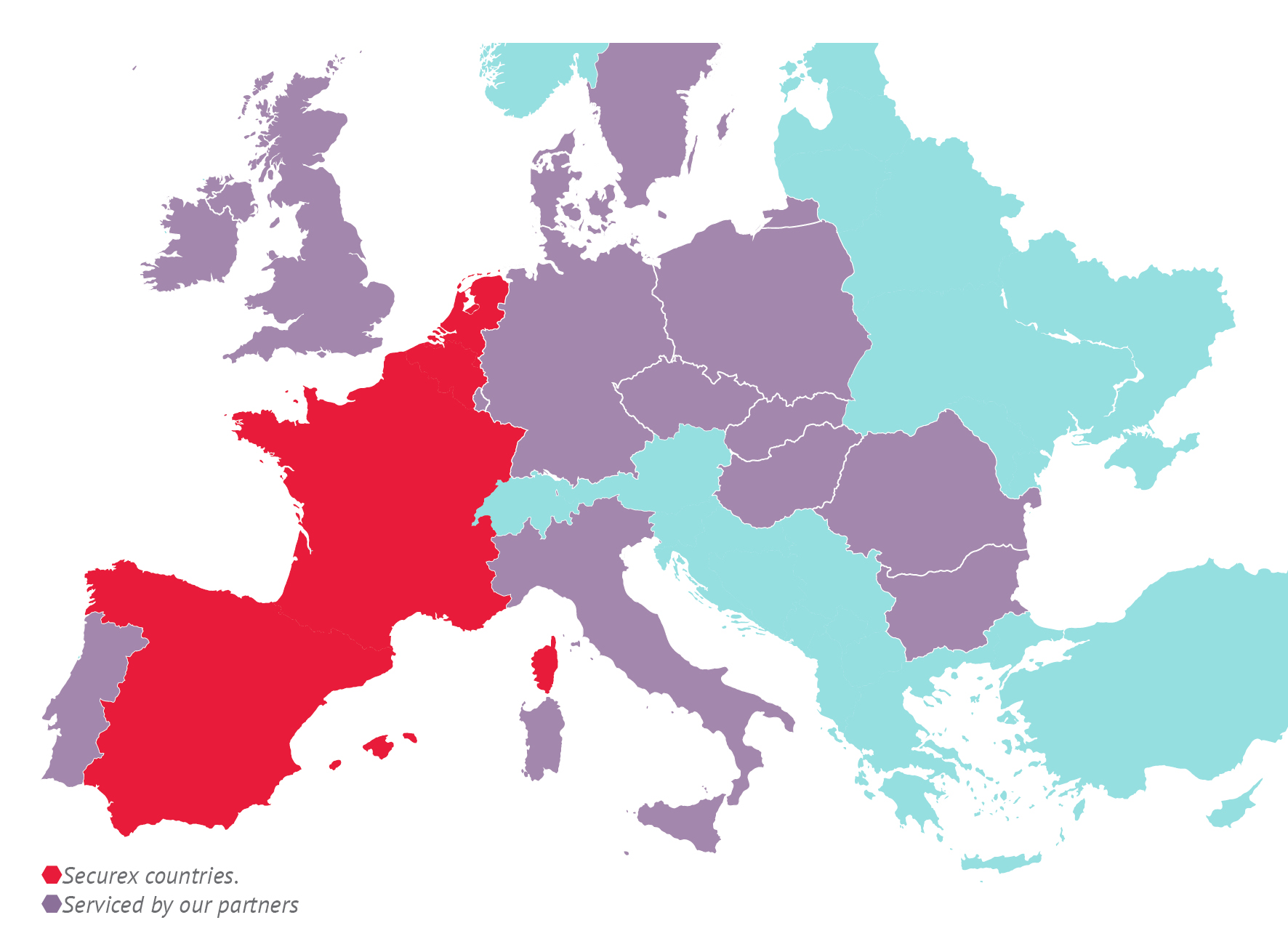

- Choose a partner that operates in more than 20 European countries through its own offices and partners

- Rely on local experts in each country

- Choose an accessible one-stop-shop, no matter which service you require

- Benefit from 115 years of experience and specialists in every field

But you needn't take our word for it. The service options we offer speak for themselves:

- Legal analysis of social and employment laws, as well as taxation

- Advice on support for salary optimisation

- Legal documents such as employment contracts, addenda, specialised clauses, and more.

- Tax support in Belgium and abroad.

- Administrative formalities such as A1 certificates and Certificates of Coverage, Limosa declarations, work permits, ...

Whether you employ foreign workers in Belgium, give Belgian employees the opportunity to work abroad or expand your company in another way: Securex delivers the service-match for your DNA.